Is Starbucks A Business Expense . the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. you may be able to claim a tax deduction for expenses you incur in carrying on your business. can i deduct starbucks as a business expense? You cannot deduct your starbucks, that is a personal expense. Starbucks’ cost structure is relatively. amateur speculative estimates range from $0.20 to $0.75.

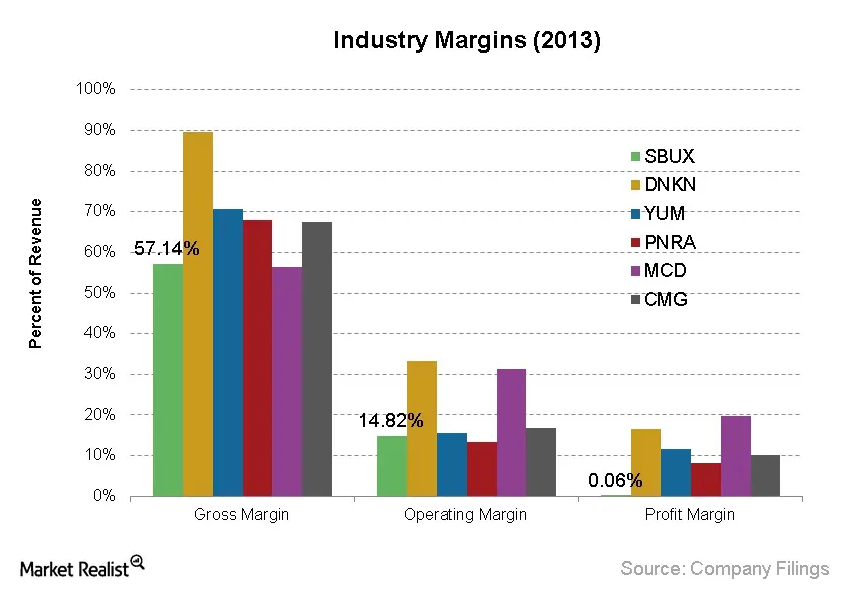

from marketrealist.com

you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses you incur in carrying on your business. Starbucks’ cost structure is relatively. can i deduct starbucks as a business expense? You cannot deduct your starbucks, that is a personal expense.

Understanding Starbucks’ cost structure and operating expenses

Is Starbucks A Business Expense Starbucks’ cost structure is relatively. Starbucks’ cost structure is relatively. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. can i deduct starbucks as a business expense? amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses you incur in carrying on your business. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. You cannot deduct your starbucks, that is a personal expense.

From www.chegg.com

Accounting Starbucks You are to submit an Is Starbucks A Business Expense you may be able to claim a tax deduction for expenses you incur in carrying on your business. You cannot deduct your starbucks, that is a personal expense. amateur speculative estimates range from $0.20 to $0.75. can i deduct starbucks as a business expense? Starbucks’ cost structure is relatively. you can claim a tax deduction for. Is Starbucks A Business Expense.

From www.youtube.com

Can I deduct Starbucks as a business expense? YouTube Is Starbucks A Business Expense Starbucks’ cost structure is relatively. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. can i deduct starbucks as a business expense? you may be able to claim a tax deduction for expenses you incur in carrying on your business. you can claim a tax deduction. Is Starbucks A Business Expense.

From www.tffn.net

How Much Does it Cost to Open a Starbucks? The Enlightened Mindset Is Starbucks A Business Expense You cannot deduct your starbucks, that is a personal expense. amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses you incur in carrying on your business. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. can. Is Starbucks A Business Expense.

From emprendimientovirtual.net

Estrategia Starbucks FourWeekMBA Emprendimiento Virtual Is Starbucks A Business Expense can i deduct starbucks as a business expense? you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. You cannot deduct your starbucks, that is a personal expense. amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction. Is Starbucks A Business Expense.

From www.nydailynews.com

Workers love to write off their Starbucks; Coffee chain is the most Is Starbucks A Business Expense the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. You cannot deduct your starbucks, that is a personal expense. amateur speculative estimates range from $0.20 to $0.75. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly. Is Starbucks A Business Expense.

From trendglimpse.com

Starbucks Business Model 2023 How Starbucks Brews Up Billions Is Starbucks A Business Expense the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. Starbucks’ cost structure is relatively. can i deduct starbucks as a business expense? amateur speculative estimates range from $0.20 to $0.75. you can claim a tax deduction for most expenses you incur in carrying on your business. Is Starbucks A Business Expense.

From gadallon.substack.com

Starbucks’ Double Shot Speed and Variety at the Expense of Quality Is Starbucks A Business Expense you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. amateur speculative estimates range from $0.20 to $0.75. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. can i deduct starbucks as a business expense?. Is Starbucks A Business Expense.

From lifeboostcoffee.com

What Is The Starbucks Coffee Traveler Everything You Need to Know Is Starbucks A Business Expense amateur speculative estimates range from $0.20 to $0.75. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. you may be able to claim a tax. Is Starbucks A Business Expense.

From scholarace.com

Marketing Strategies Analysis Business GrowthStudy Of Starbucks Is Starbucks A Business Expense amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses you incur in carrying on your business. can i deduct starbucks as a business expense? you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. Starbucks’. Is Starbucks A Business Expense.

From www.appeconomyinsights.com

☕️ Starbucks The Star economy by App Economy Insights Is Starbucks A Business Expense you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. You cannot deduct your starbucks, that is a personal expense. can i deduct starbucks as a business expense? you may be able to claim a tax deduction for expenses you incur in carrying on your business.. Is Starbucks A Business Expense.

From www.educba.com

Accrued Expense Examples of Accrued Expenses Is Starbucks A Business Expense amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses you incur in carrying on your business. can i deduct starbucks as a business expense? you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. Starbucks’. Is Starbucks A Business Expense.

From www.entrepreneur.com

The 5 Restaurants That Corporate Workers Expense the Most Is Starbucks A Business Expense You cannot deduct your starbucks, that is a personal expense. you may be able to claim a tax deduction for expenses you incur in carrying on your business. amateur speculative estimates range from $0.20 to $0.75. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. Starbucks’ cost. Is Starbucks A Business Expense.

From en.ppt-online.org

Starbucks coffee company online presentation Is Starbucks A Business Expense Starbucks’ cost structure is relatively. You cannot deduct your starbucks, that is a personal expense. amateur speculative estimates range from $0.20 to $0.75. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. you can claim a tax deduction for most expenses you incur in carrying on your. Is Starbucks A Business Expense.

From www.statista.com

Chart Starbucks Holds More Cash Than Many Banks Statista Is Starbucks A Business Expense You cannot deduct your starbucks, that is a personal expense. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. amateur speculative estimates range from $0.20 to $0.75. the purpose of my coffee purchase will determine whether and how much i can deduct as a business. Is Starbucks A Business Expense.

From www.slideshare.net

The Starbucks Process(Customer Perspective) Is Starbucks A Business Expense amateur speculative estimates range from $0.20 to $0.75. the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. you may be able to claim a tax deduction for expenses you incur in carrying on your business. you can claim a tax deduction for most expenses you incur. Is Starbucks A Business Expense.

From www.feedough.com

Understanding Starbucks' Business Strategy Feedough Is Starbucks A Business Expense can i deduct starbucks as a business expense? the purpose of my coffee purchase will determine whether and how much i can deduct as a business expense. You cannot deduct your starbucks, that is a personal expense. amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses. Is Starbucks A Business Expense.

From marketrealist.com

Understanding Starbucks’ cost structure and operating expenses Is Starbucks A Business Expense can i deduct starbucks as a business expense? amateur speculative estimates range from $0.20 to $0.75. you may be able to claim a tax deduction for expenses you incur in carrying on your business. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. . Is Starbucks A Business Expense.

From amynorthardcpa.com

Can I deduct Starbucks as a business expense? The Accountants for Is Starbucks A Business Expense amateur speculative estimates range from $0.20 to $0.75. can i deduct starbucks as a business expense? Starbucks’ cost structure is relatively. you can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related. You cannot deduct your starbucks, that is a personal expense. the purpose of my. Is Starbucks A Business Expense.